Cashflow & Business Loans

Equipment finance

made easy

Is your business experiencing temporary cash flow challenges? At Roam Finance, we understand that managing cash flow fluctuations can be a daunting task. That’s why we offer cash flow loans designed to provide you with the necessary working capital to bridge the gap and keep your operations running smoothly.

How it works

Cashflow for business

At Roam Finance, we specialise in providing tailored cash flow solutions to businesses like yours. We know that unexpected expenses, delayed payments, or seasonal fluctuations can cause temporary cash flow gaps that can hinder your day-to-day operations. Our cash flow loans are designed to help you overcome these challenges and maintain a healthy cash flow.

01

Quick and Convenient

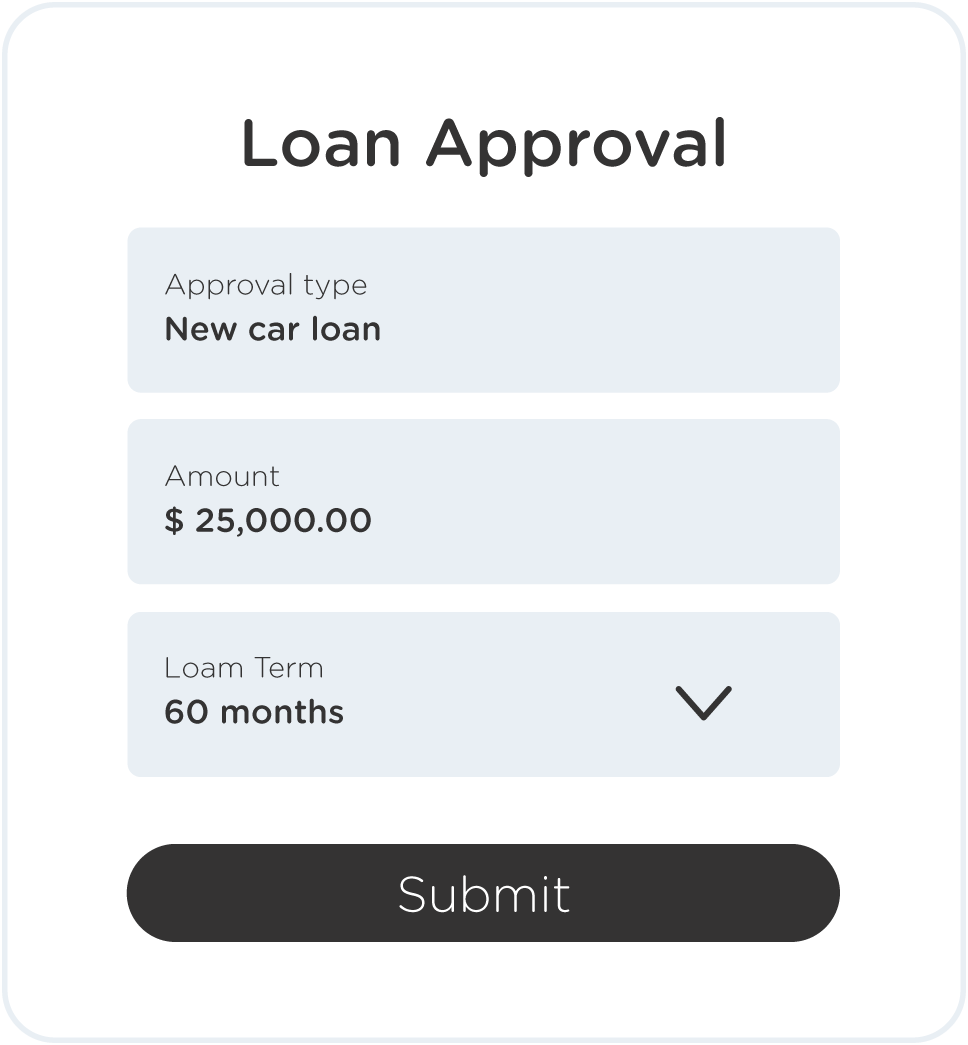

We understand that when it comes to cash flow, timing is crucial. Our streamlined application process ensures a quick turnaround time, allowing you to access the funds you need in a timely manner. Whether you require immediate working capital or want to establish a line of credit for future needs, we have solutions to meet your requirements.

02

Flexible Repayment Options

We offer flexible repayment options that align with your cash flow patterns. Our team will work closely with you to develop a repayment plan that suits your business, whether it’s monthly, quarterly, or seasonal payments. This flexibility ensures that your loan repayments are manageable and do not further strain your cash flow.

03

Competitive Rates

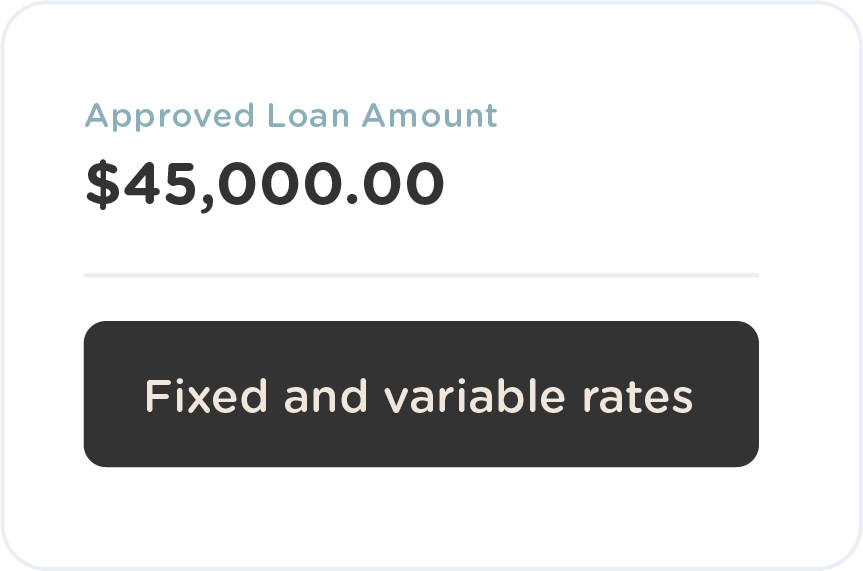

We believe in providing our customers with competitive interest rates and terms. Our team has established relationships with financial institutions, allowing us to secure favorable rates that can help you minimise costs and maximise profitability.

04

No Restriction

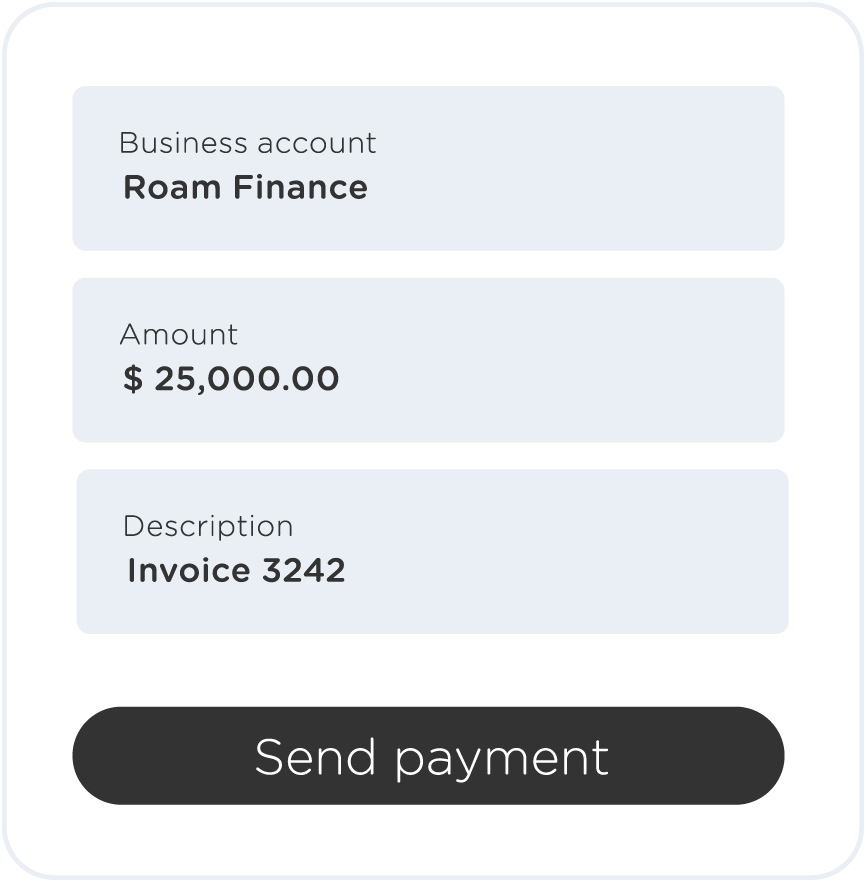

Unlike traditional loans that may have restrictions on how the funds can be used, our cash flow loans give you the freedom to allocate the funds where they are needed most. Whether it’s covering payroll, purchasing inventory, managing overhead costs, or seizing growth opportunities, our loans offer the flexibility to address your specific cash flow needs.

05

Expert Guidance

Our dedicated team of financial experts is committed to supporting your business every step of the way. We will take the time to understand your unique cash flow challenges and work collaboratively to find the best solution for your needs. Our goal is to be your trusted financial partner, offering guidance and advice to help you navigate through any cash flow hurdles you may encounter.

Features

Cashflow for growth

Don’t let temporary cash flow constraints hold your business back. With Roam Finance’s cash flow loans, you can secure the working capital you need to keep your operations running smoothly and seize opportunities for growth. Contact us today to discuss your cash flow requirements and discover how we can support your business’s financial success.

Loan Options

Term loan or overdraft/line of credit available

Facility

Flexible facility terms

Loan Amounts

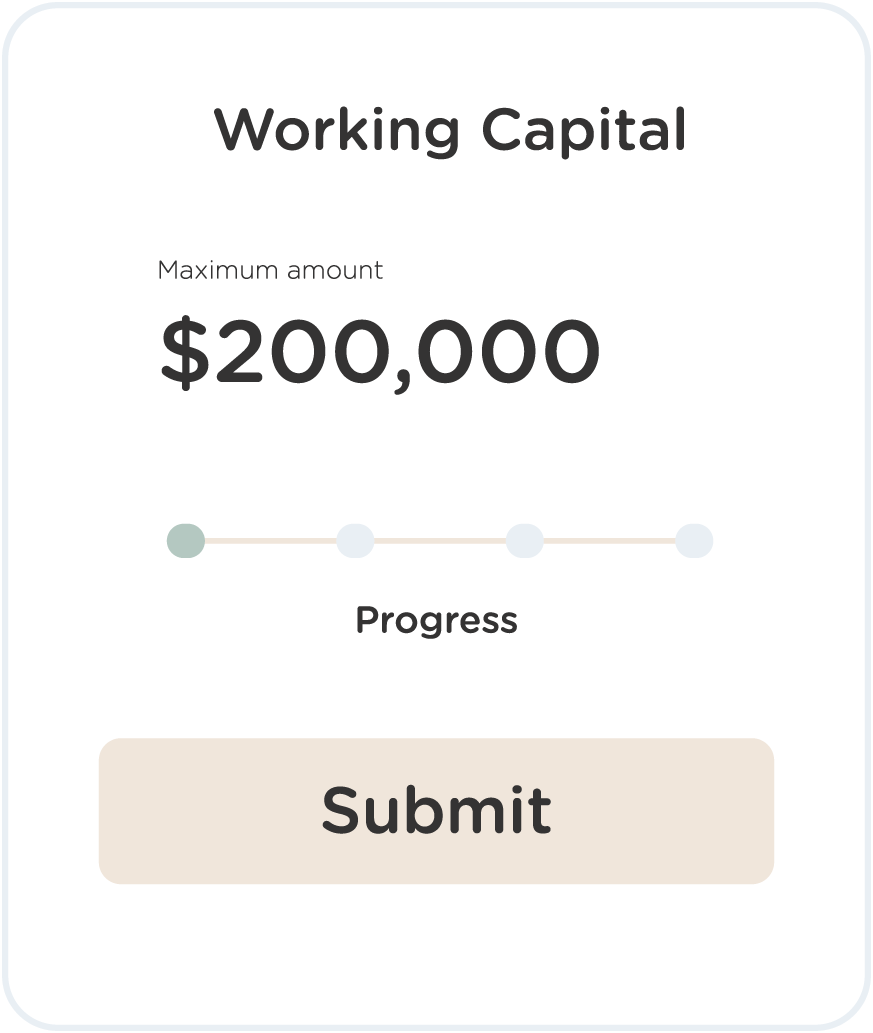

Loan amounts are based on a percentage of average turnover

Turn Around

Fast turn around of approval

Business cashflow that works

Roam Finance understands the challenges you face, which is why we offer tailored cash flow finance solutions to keep your operations running smoothly. Our flexible funding options empower you to seize opportunities, meet your obligations, and drive growth. Discover the financial freedom your business deserves with Roam Finance.

Custom cashflow loans

Our approach ensures that your financing aligns perfectly with your revenue, providing the flexibility you need to manage expenses, seize opportunities, and foster growth. Experience financial solutions as unique as your business with Roam Finance.

Lending Partners

With 30+ leading partners, Roam Finance has access to the best rates on the market. Whether you’re looking for a personal loan or business asset financing, we have the loan product for you and your needs.