Learning Centre

Understanding Asset Finance

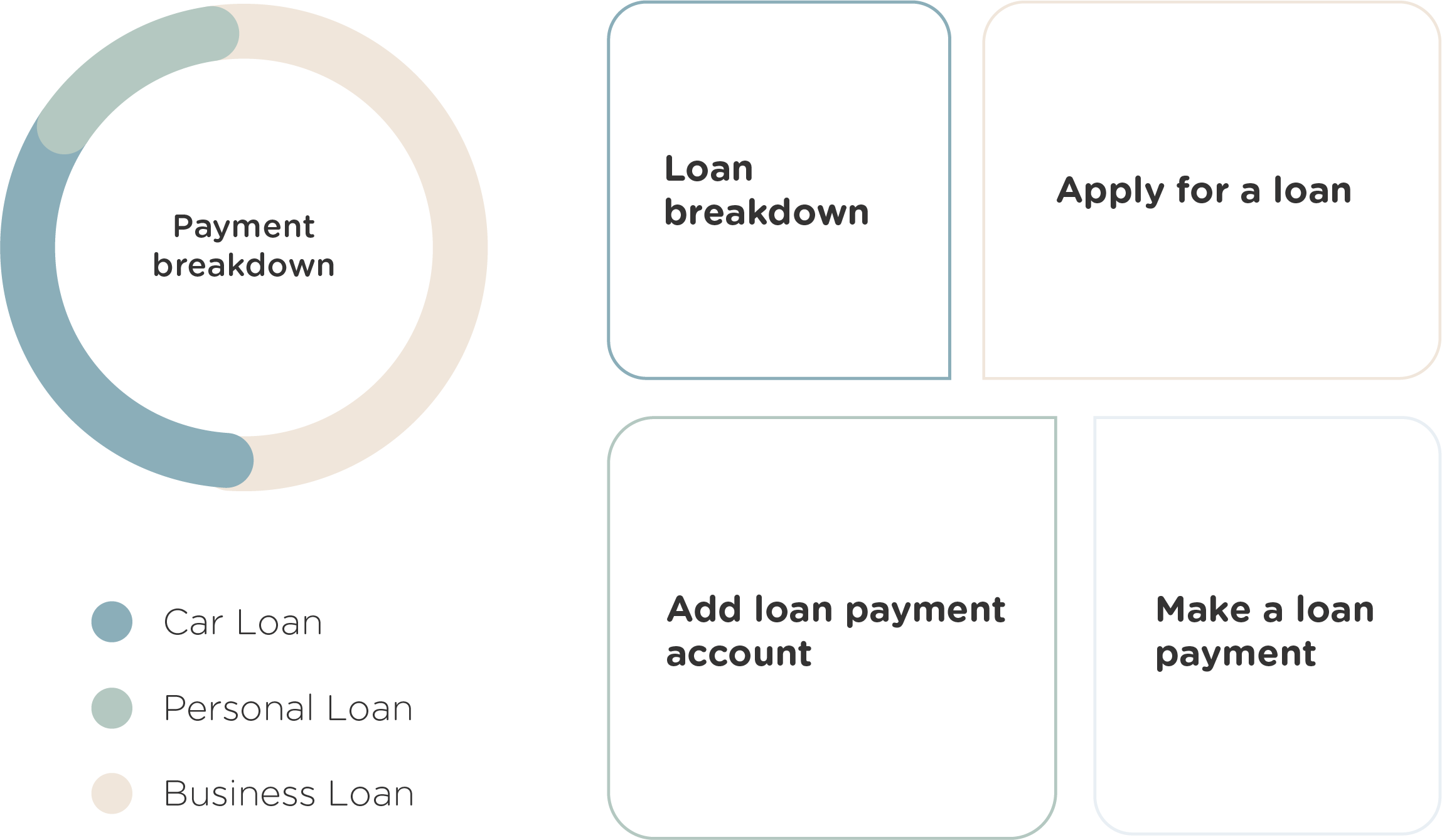

Roam Finance is where your financial aspirations find a home. We’re dedicated to providing a comprehensive suite of services that cater to your diverse needs, ensuring you have the right financial tools to navigate the paths of your dreams. Explore our range of services designed to empower your financial journeys.

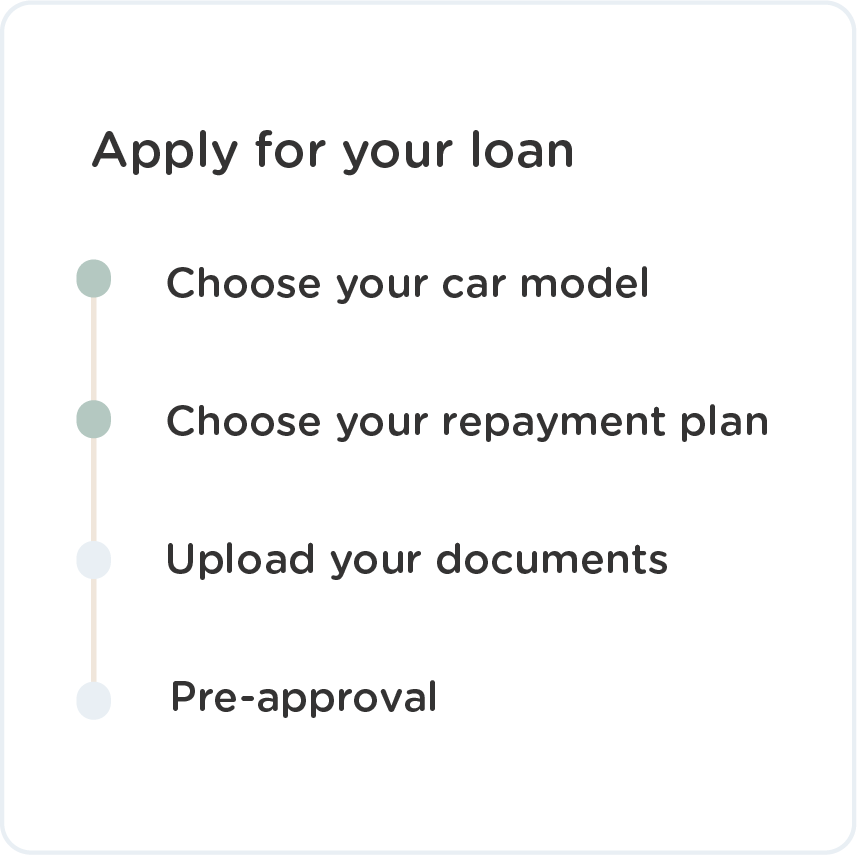

How it works

What's the difference?

Welcome to the Roam Finance Learning Centre, where we aim to demystify the various loan types and options available to you. Understanding these distinctions is crucial to making informed financial decisions. Let’s delve into the specifics to help you navigate the world of loans and find the best fit for your needs.

01

Car Lease: Driving Flexibility

A car lease offers the advantage of low upfront costs and predictable monthly payments. At the end of the lease term, you typically have the choice to either purchase the vehicle or upgrade to a newer model. Leasing is particularly suited for those who enjoy driving the latest models and want to avoid the long-term commitment of vehicle ownership.

02

Chattel Mortgage: Ownership from Day One

Choosing a chattel mortgage means owning the vehicle from the outset. The finance is secured by the vehicle itself, making it a popular choice for businesses seeking immediate ownership and tax benefits. Interest rates are often competitive, and GST can be claimed back for eligible business purposes.

03

Commercial Hire Purchase (CHP): Gradual Ownership

Commercial Hire Purchase offers a path to vehicle ownership through gradual payments. It combines elements of both a lease and a loan, allowing businesses to claim depreciation and interest charges for tax benefits. Once the final payment is made, ownership is transferred to you.

04

Car Loan: Traditional Financing

A car loan, also known as a secured car loan, provides straightforward financing for purchasing a vehicle. With fixed interest rates and flexible terms, this option allows you to own the vehicle outright from the beginning. The vehicle itself serves as collateral for the loan.

05

Personal Loan: Versatile Financing

A personal loan offers financial flexibility, as it can be used for various purposes, including vehicle purchase. This unsecured loan may have higher interest rates compared to secured options like car loans, but it provides the freedom to allocate the funds as needed.

06

Novated Lease: Adding Benefits to the Drive

A novated lease is a three-way agreement between an employer, an employee, and a finance company. It allows employees to lease a vehicle using pre-tax income, resulting in potential tax savings. This arrangement offers convenience and financial advantages for individuals whose employers provide this benefit.

07

Luxury Car Tax (LCT): Understanding the Extra Cost

Luxury Car Tax is an additional tax imposed on vehicles with a luxury value exceeding a certain threshold. If you’re considering a high-end vehicle, it’s important to factor in LCT, as it can significantly impact the overall cost of ownership.

08

Motor Vehicle Stamp Duty:

Tax on Ownership

tamp duty is a state-based tax levied on the transfer of motor vehicle ownership. Rates vary depending on the state or territory you’re in and the value of the vehicle. It’s an essential consideration when calculating the total cost of purchasing a vehicle.

09

Personal Property Securities Register (PPSR): Securing Your Investment

The PPSR is a national online register that allows you to check if there’s any money owing on a used vehicle you’re considering purchasing. It helps protect buyers from buying vehicles with outstanding debts or other financial obligations.

10

Secure Car Loan: Collateral for Confidence

A secure car loan requires collateral, usually the vehicle being financed. This type of loan often offers lower interest rates due to the reduced risk for the lender. It’s a popular option for those who want to own the vehicle outright from the start.

11

Green Car Loan: Driving Environmental Consciousness

Green car loans, also known as eco-friendly car loans, incentivize environmentally friendly choices. These loans may offer lower interest rates for vehicles that meet certain emissions or fuel efficiency standards, encouraging eco-conscious driving.

12

Commercial Finance: Empowering Business Growth

Commercial finance encompasses a range of funding solutions tailored for businesses. Whether you’re expanding operations, acquiring equipment, or investing in commercial property, our expertise in commercial finance ensures you have access to the right resources to propel your business forward.

13

Property Finance: Realising Property Dreams

Property finance isn’t just about buying a home; it encompasses a myriad of possibilities, from residential to commercial properties. Our experts can help you secure the right financing solution for property acquisition, development, investment, or refinancing.

Insurance is a crucial aspect of asset ownership, offering protection against unexpected events. Whether it’s vehicle insurance, property insurance, or insurance for other assets, having the right coverage ensures your investments are safeguarded.

14

Caravan Finance: Exploring the Open Road

Caravanning represents freedom and exploration. Caravan finance allows you to finance your mobile home, giving you the means to embark on unforgettable journeys and create memories on the open road.

15

Boat Finance: Sailing Toward Adventure

Boat financing paves the way for maritime escapades. Whether you’re dreaming of a sleek yacht, a fishing boat, or a family-friendly vessel, boat finance can help you set sail on your aquatic adventures.

16

Roam Finance: Securing Your Investment

We offer a wide range of financing options to cater to your specific needs. Whether you’re looking for traditional car loans, lease agreements, or balloon payment plans, we have solutions to accommodate various preferences and financial situations. We’ll help you explore the available options and guide you towards the one that best suits your circumstances.

The asset partner in

your corner

Roam Finance is your compass, guiding you through an array of financing options that extend far beyond vehicles. From commercial endeavors to property aspirations, from safeguarding your investments to embarking on maritime and caravanning explorations, we’re here to make your financial journey seamless and rewarding. Stay tuned for our upcoming insights into additional facets of finance to ensure you’re equipped with the knowledge you need for your ventures.

Why Roam

Finance?

Roam Finance is committed to ensuring you’re well-informed about all aspects of car finance. Whether you’re diving into novated leases, understanding the implications of luxury car tax, or grasping the mechanics of secure and green car loans, we’re your guide to making the right financial decisions for your journey ahead. Stay tuned for our upcoming insights into more car finance intricacies and options.

Lending Partners

With 30+ leading partners, Roam Finance has access to the best rates on the market. Whether you’re looking for a personal loan or business asset financing, we have the loan product for you and your needs.